Discovering the Best Indicators for Pocket Option Trading

Understanding the Best Indicators for Pocket Option

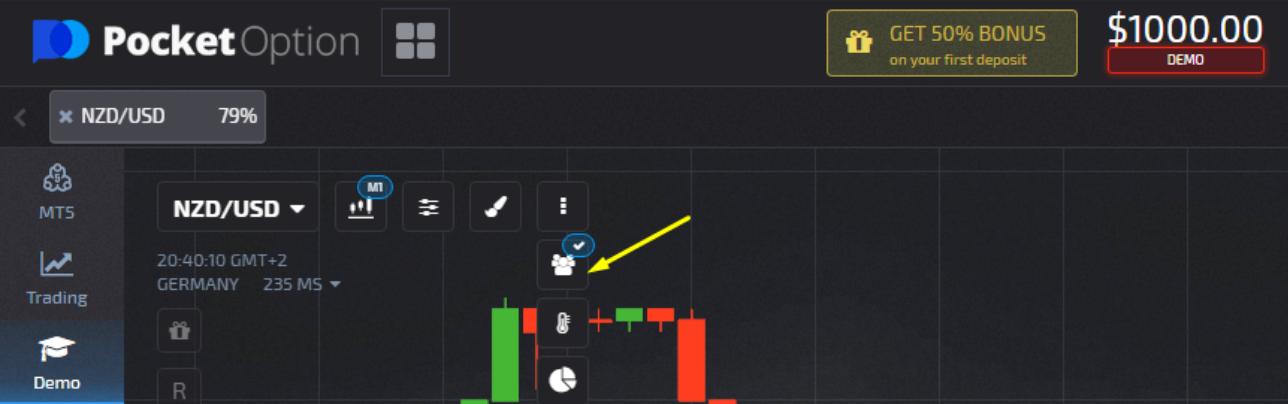

Trading on platforms like Pocket Option can be highly lucrative, but it requires a solid understanding of market indicators. One essential aspect to master in trading is having the best indicators for pocket option best indicators for pocket option at your disposal. Indicators help traders make informed decisions based on price movements and patterns. In this comprehensive guide, we will explore various indicators, their functionalities, and how you can use them effectively to enhance your trading experience on Pocket Option.

What Are Trading Indicators?

Trading indicators are statistical calculations based on the price and/or volume of a security. They are plotted on charts and used by traders to forecast future price movements. The objective of using indicators is to identify potential buy or sell opportunities, thereby increasing the chances of profitable trades.

Types of Indicators for Pocket Option

There are numerous trading indicators available that traders can employ. Below, we will discuss some of the most popular and effective indicators that work best for Pocket Option.

1. Moving Averages (MA)

Moving Averages are one of the most commonly used indicators in trading. They help smooth out price data by creating a constantly updated average price. The two most popular types are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). MAs can indicate trends and potential reversals:

- Simple Moving Average (SMA): Provides an average price over a period, helping to identify trend direction.

- Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to new information.

2. Relative Strength Index (RSI)

The Relative Strength Index is a momentum oscillator that measures the speed and change of price movements. RSI provides insights into whether an asset is overbought or oversold, which can signal potential reversal points:

- RSI values above 70 indicate an overbought condition.

- RSI values below 30 indicate an oversold condition.

3. Moving Average Convergence Divergence (MACD)

The MACD indicator is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It consists of the MACD line, signal line, and histogram:

- A bullish signal occurs when the MACD line crosses above the signal line.

- A bearish signal occurs when the MACD line crosses below the signal line.

4. Bollinger Bands

Bollinger Bands consist of a middle band (SMA) and two outer bands (standard deviations above and below the SMA). They provide insights into market volatility and potential price reversals. When the price touches the upper band, it may indicate an overbought condition, while touching the lower band may indicate an oversold condition.

5. Stochastic Oscillator

This momentum indicator compares a particular closing price of a security to a range of its prices over a certain period. The Stochastic Oscillator has a range from 0 to 100, helping traders identify overbought or oversold conditions:

- Values above 80 indicate overbought conditions.

- Values below 20 indicate oversold conditions.

How to Use Indicators in Pocket Option

Using indicators in Pocket Option effectively involves integrating them into your trading strategy. Here are some tips:

- Combine Indicators: Using multiple indicators can provide more comprehensive signals. For example, combining MACD and RSI can help confirm potential entry or exit points.

- Set Appropriate Time Frames: Different indicators can be more effective on different time frames. Experiment with various time periods to find what works best for your trading style.

- Backtesting: Test your chosen indicators using historical data to gauge their effectiveness before applying them in live trading.

- Stay Updated on Market News: Indicators are helpful, but they should not be the only aspect of your trading strategy. Stay informed about economic news and events that may impact market conditions.

Common Mistakes to Avoid

As you implement indicators in your trading, be aware of common mistakes that can hinder your success:

- Overcomplicating Your Strategy: Using too many indicators can lead to confusion. It’s often more effective to use a few reliable indicators.

- Ignoring Market Context: Indicators are not foolproof. Consider the broader market context to avoid false signals.

- Emotional Trading: Stick to your trading plan and avoid making impulsive decisions based on short-term market fluctuations.

Conclusion

Understanding and effectively using the best indicators for Pocket Option can significantly enhance your trading performance. By implementing tools such as Moving Averages, RSI, MACD, Bollinger Bands, and Stochastic Oscillators, traders can gain deeper insights into market trends and potential trading opportunities. Always remember, successful trading requires a blend of analytical tools, market knowledge, and a disciplined approach. Start exploring these indicators today, and elevate your Pocket Option trading experience to new heights.